What is Financial Literacy?

The ability to understand how money works in the world, including how money is earned, budgeted, borrowed, and saved. Understanding these financial concepts can help you make smarter choices when it comes to managing your money, from paying bills to using credit cards to buying a car or a home.

Seems simple, and yet only 57% of Americans are financially literate according to the first-ever S&P Global Financial Literacy Survey, a detailed and comprehensive analysis of worldwide financial literacy by the World Bank, Gallup, and George Washington University. In fact, when compared to other countries worldwide, the U.S. fails to even make the top ten, instead ranking at 14th.

Seems simple, and yet only 57% of Americans are financially literate according to the first-ever S&P Global Financial Literacy Survey, a detailed and comprehensive analysis of worldwide financial literacy by the World Bank, Gallup, and George Washington University. In fact, when compared to other countries worldwide, the U.S. fails to even make the top ten, instead ranking at 14th.

How Financially Literate Are You?

According to a 2021 IPSOS poll, the average American rated themselves as financially literate. Yet, the results of a financial literacy quiz showed that one in three people were not as financially literate as they had thought.

Why Does it Matter?

Money is something every one of us deals with throughout the majority of our lives. It is also the cause of stress for many people. In fact, 42% of people worry about meeting their everyday living expenses, 40% are concerned about their financial situation, and 37% report they are just getting by financially.(1)

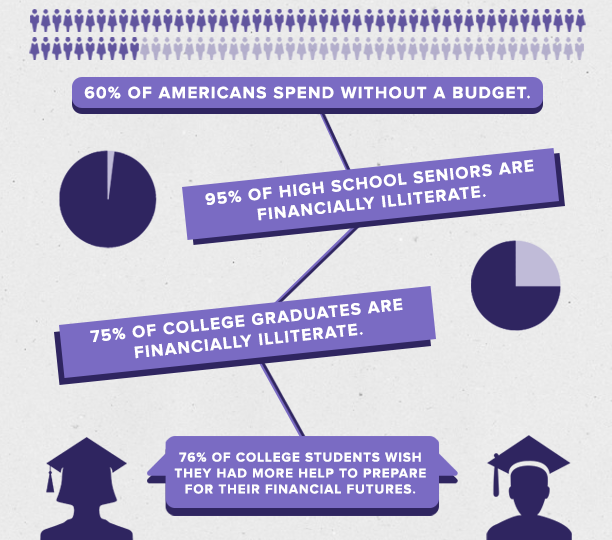

Unfortunately, most of us are not given any formal training on how to manage money. Only 24 states require high school students to take a course in either economics or personal finance in order to graduate.(2) It’s no wonder that nearly three-quarters of teens don’t feel confident in their personal finance knowledge.(3)

Unfortunately, most of us are not given any formal training on how to manage money. Only 24 states require high school students to take a course in either economics or personal finance in order to graduate.(2) It’s no wonder that nearly three-quarters of teens don’t feel confident in their personal finance knowledge.(3)

With little to no education in personal finance, people are left to figure things out on their own, and most aren’t doing such a great job of managing their finances. A June 2022 survey found that 61% of Americans were living paycheck to paycheck.(4) More than one-fourth of adults had one or more bills that they were unable to pay in full or were one $400 financial setback away from being unable to pay their bills at all.(5) Compounding this problem is the over $9,000 in credit card debt carried by the average U.S. household.(6)

What these startling statistics demonstrate is a systematic lack of education and understanding of personal finances, and the result is a financial illiteracy epidemic that is currently plaguing our country.

What these startling statistics demonstrate is a systematic lack of education and understanding of personal finances, and the result is a financial illiteracy epidemic that is currently plaguing our country.

The Solution

EDUCATION. It has been shown that financial education improves financial knowledge and positively impacts important financial behaviors, such as budgeting, saving, credit, and insurance. However, the time to start financial education is when people are young - middle and high school - before they need to make financial decisions and before bad financial habits form that could carry over into adulthood.

By providing financial education in schools and making it available to the communities who need it most, we can empower Americans to be financially literate and achieve their dreams. The best way to build a better tomorrow is to educate people today.

By providing financial education in schools and making it available to the communities who need it most, we can empower Americans to be financially literate and achieve their dreams. The best way to build a better tomorrow is to educate people today.